After hitch-hiking across the Chilean border in three different vehicles, including a police car, during the tail-end of the pandemic, with none of the correct paperwork (besides my passport), I arrived in Mendoza, Argentina expecting to be in a world much more reasonable than the expensive Chile I had just escaped.

Everyone I had spoken to prior has said that, for tourists, Argentina is very cheap. I was so confused when I got out of the car of the man I had hitch-hiked with, walked to a bar, and discovered that Mendoza was pretty much the same price as the UK. I just assumed that it was the London of Argentina, and didn’t think much of it.

That was Idiot Abroad Mistake 1. Idiot Abroad Mistakes 2-10 were the fact that I didn’t ask anyone in Argentina about why it was so seemingly not cheap, and for not just googling the damn answer.

It was after at least two weeks of being in this magical country, paying full price, on card, like a gringa idiota, that I met Hani. Hani is a French CEO of his recruitment company Humanup.io, and we met in Bariloche at a Selina hostel where my new travelling bestie Estelle and I were staying over Christmas 2021.

During a conversation Hani was saying he found Argentina to be very cheap, and Estelle and I looked at eachother, baffled. Later that evening on Christmas Eve I went to pay for some drinks on my card, and Hani looked at me agast, and said, “what are you doing?”

Me: “Paying for drinks?”

Hani: “Never on card!”

This turned into a lesson on the Blue Dollar, from someone actually great at all things money, and it is fair to say that Estelle and I felt very silly.

This post is to show you how to get half price money too. It requires a little planning, and patience, and often a fair bit of walking, but it is safe, and easy, and truly makes Argentina very affordable indeed.

Firstly, here is a TikTok that I made highlighting how to get the Blue Dollar in Buenos Aires. I’d appreciate a like and follow if you fancy it.

Okay, now for some (now) wise words:

The inflationary currents here are wild, and introduce a level of economic dynamism unfamiliar to most Europeans or North Americans.

The cost of travel to Argentina can sway dramatically, with periods of high pricing and, conversely, periods of remarkable affordability; as is the case right now in 2023.

For those venturing from the Northern Hemisphere, the current economic climate makes Argentina an exceptionally budget-friendly destination.

The official currency is the Argentinian Peso, usually marked with the same dollar sign, $.

Even though the peso plays the official role, Argentinesare often happy to trade in the US dollar. Thanks to the rollercoaster economy, many folks here play it safe by hiding away their savings in greenbacks to dodge the inflation drama.

To complicate matters, the current president (Alberto Fernandez) has set down strict rules on how many dollars an Argentine can legally purchase each month – a measly US$200.

Let me introduce you to the Blue Dollar and the Black Market.

The “Dolar Blue” is like the unofficial exchange rate that is doing a side hustle alongside the official one.

As of my last check, the numbers are actually quite hard to believe. The official rate is around ARS$260 per US$1, whereas the Blue Dollar rate is around ARS$520.

You don’t have to be a great mathematician to see that that’s an extreme travel win.

How to Secure Cash & Navigate Currency Exchange in Argentina

Now, let’s get into the, “how,” of accessing cheap cash in Argentina.

- Western Union in Big Cities

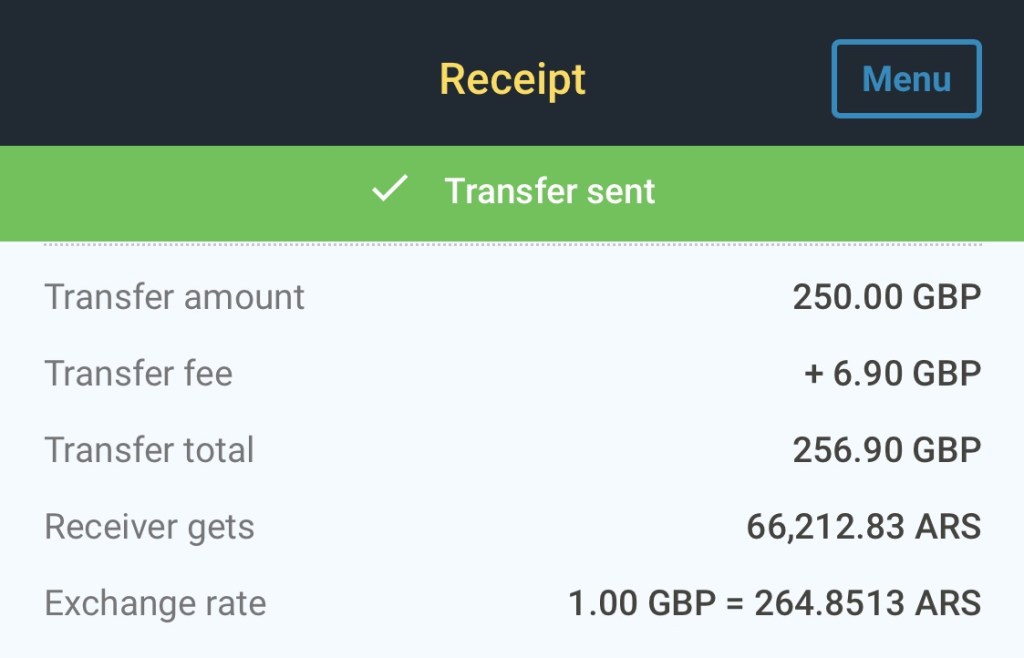

If you’re in Buenos Aires or other major cities in Argentina, Western Union is your golden ticket to the Blue Dollar rate. They offer a fantastic rate, and it’s a service you know and trust.

Promo codes for fee waivers are a bit elusive, however your first transfer is typically free, so make it count.

Quick Tips for Western Union:

– Download the app.

– Use your FULL name as per your ID/Passport.

– Always bring your passport when picking up the transfer.

– It’s not an in-person exchange house – you’ll wire money to yourself using a credit card, debit card, or bank account.

– Debit and credit card transfers are swift, while bank transfers may take 4-5 business days but have lower fees.

- Western Union in Small Cities

In cities like El Calafate or Puerto Iguazu, WU is still an option, but with limits around 60k-80k pesos ARS. And no, you can’t split a big transfer for a partial pick-up later.

These smaller spots may have limited reserves and long queues. You can either cash-out before they open, or towards the end of the day, hoping for a fresh influx of cash; or arrive prepared with cash from a bigger city branch; or explore local “cuevas.”

Cuevas are slightly riskier, but still offer a great, if not better exchange rate than WU. You can sometimes find them on Google, but often they are best found by asking a local.

If you’re short on time in these destinations, consider making a hefty transaction in Buenos Aires, and taking the pesos with you. WU is still usable outside the capital, but small branches often don’t have the amount of cash that you might want.

What Can I Buy With Cash?

Everything. I bought everything that I could with cash: hostels, hotels, all food, experiences, gifts, even a Christmas splurge of a massage. As long as you are willing to risk that it might be sold out by the time you get to it, you can buy it in cash.

IMPORTANT:

If you look like a tourist, leaving a WU with arms full of cash, and it’s on the edge of dark, you are at a much higher chance of being mugged. Personally I have never heard of anyone being mugged after visiting a WU, but for sure it happens.

Use your head. Take a money-wallet / bumbag with you, and wear it under your jumper. Equally if you’re staying in hostels make sure that you have a really good padlock for locking away your money in the hostel lockers when you go out and about.

You don’t want to be caught carrying US$500 around with you. Get creative with your safety.

Dolar Turista: Navigating Debit, Credit Cards, and ATMs in Argentina

As of late 2022, using your foreign credit card in Argentina was a big no-no due to being saddled with the official rate. However, a new pact between the government, Visa, and Mastercard now tags foreign Visa and MC users with the MEP rate. This change kicked in successfully from December 2022, bringing relief to those averse to carting around wads of cash.

– Cash Still Rules: For minor transactions, cash is king. Argentina’s cash-centric economy and the lucrative Blue Dollar rate in WUs, and cuevas make cash your go-to for discounts and with smaller establishments.

– Credit Card Queries:

– Mastercard starts with the official rate, but promptly refunds the difference to match the MEP rate within a few days.

– Visa charges the MEP rate straight away.

– Verify Visa’s MEP rate through their currency exchange calculator, ensuring you select ARS to USD.

– Reports confirm success in using this system within Argentina, even for online purchases from an Argentine site while abroad. A word of caution: don’t just convert foreign bookings to pesos; you’ll still be billed in dollars.

– QR Code: Businesses must accept debit cards for purchases over 100 pesos, except if they opt for QR code payments – often via MercadoPago app. Sadly, tourists can’t dive into this QR fun without a local DNI ID for a MercadoPago account.

Moral of the story: keep some cash tucked away just in case.

– ATMs (Visa or MC) reportedly dispense the official rate, so avoid this route for obtaining pesos.

– Low withdrawal limits and hefty bank fees (around U$10 per transaction) make ATMs a less favourable choice.

– If you’re forced into an ATM situation, consider using a bank like Charles Schwab, which refunds foreign ATM fees, sparing you a painful fee collection.

I hope all of this makes sense. It is sort of simple once you get your head around it, I just hope that you have googled this topic before you spent your first ARS $!

A big hug, get and see the world!

Rhianna < 3

One thought on “Double Your Money: Everything You Need to Know About Argentina’s Blue Dollar.”